A chattel mortgage record is a bit like a special kind of document or record that keeps track of a specific type of loan agreement. Imagine you want to buy something expensive, like a car or a piece of equipment, but you don’t have enough money to pay for it all at once. You might decide to get a loan. In a chattel mortgage, the item you’re buying (like the car or equipment) is used as a kind of security for the loan. This means if you can’t pay back the loan, the lender can take the item to cover the money you owe.

What’s in a chattel mortgage record?

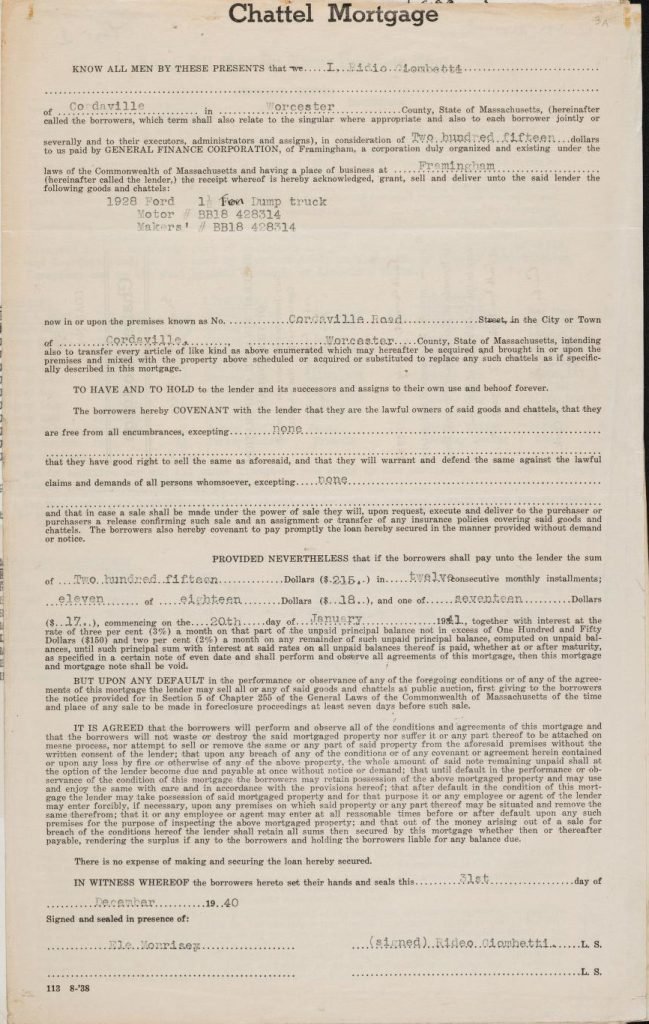

This record would include several important pieces of information:

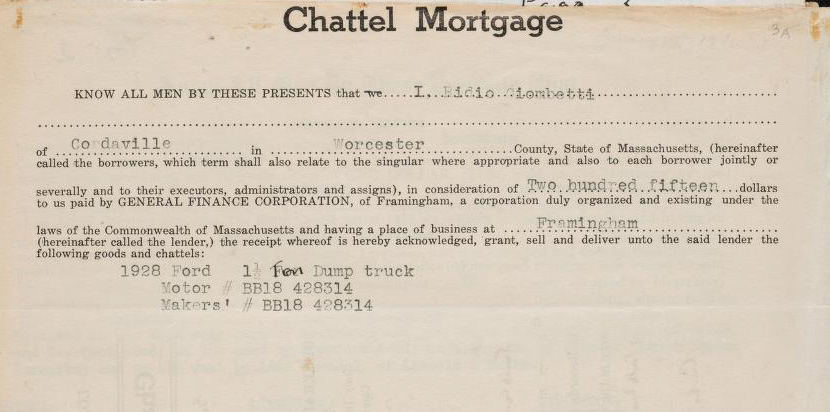

- Details of the Borrower and Lender

It lists who is borrowing the money and who is lending it. This includes names and contact information. - Description of the Chattel

This is a detailed description of the item that’s being used as security for the loan. If it’s a car, for example, this part would include the make, model, year, and even the vehicle identification number (VIN). - Loan Amount and Terms

This section shows how much money is being borrowed and the terms of the loan. This includes how long you have to pay back the money, the interest rate, and any other conditions. - Repayment Schedule

Here, you’d find a schedule that outlines when payments need to be made and how much each payment will be. - Legal Clauses

These are the rules that both the borrower and the lender have to follow. It might include what happens if payments are missed or what the borrower can and can’t do with the item while it’s under the chattel mortgage. - Signatures

Finally, the record will have a place for both the borrower and the lender to sign, making it an official agreement.

Think of a chattel mortgage record like a detailed contract that protects both the person getting the loan and the person giving it. It makes sure everyone knows what’s expected and what will happen with the item that’s being used as security for the loan.

Example Chattel Mortgage